PERFECT PAYCHECK ROUTINE

CHECKLIST

The step-by-step guide to making your paycheck work for you: Increase your savings, decrease your debt, invest for the future and enjoy life now!

None of us want to work until we're in our 60s. Turn your paycheck into a tool that will help you save more, spend wisely and grow your money now - so you can enjoy life (and NOT work) later!

HOW THIS WORKS

Let's face it. Many of us are spending impulsively and I don't want us to stop completely. However, as a fellow 9-5 corporate baddie, I want to help you to create a realistic plan so you can save, cover your bills confidently and still enjoy life.

Here's what I don't

want for us:

-Working until we're in our 60s

-Living for the now, and not saving for the unexpected

-Dying with our debt, and missing out on the "unofficial" pay increase

-Overworking ourselves as we mature in age, when we should be resting

We work hard enough. It's time for our paychecks to start working for us.

AT THE END OF THIS CHECKLIST, YOU'LL BE CLEAR ON:

Where your money is going

Where your money is going

You'll have a clear idea of where your money is coming from and where it's going each month.

Where you can save more money

Where you can save more money

Having a view into where you can save more will make you feel empowered to take action.

Where you can spend more wisely

Where you can spend more wisely

Knowing where each dollar is going helps relieve stress and confidently cover bills.

When or where to invest

When or where to invest

How to use your 9-5 income to jumpstart or advance your investment journey, without another job.

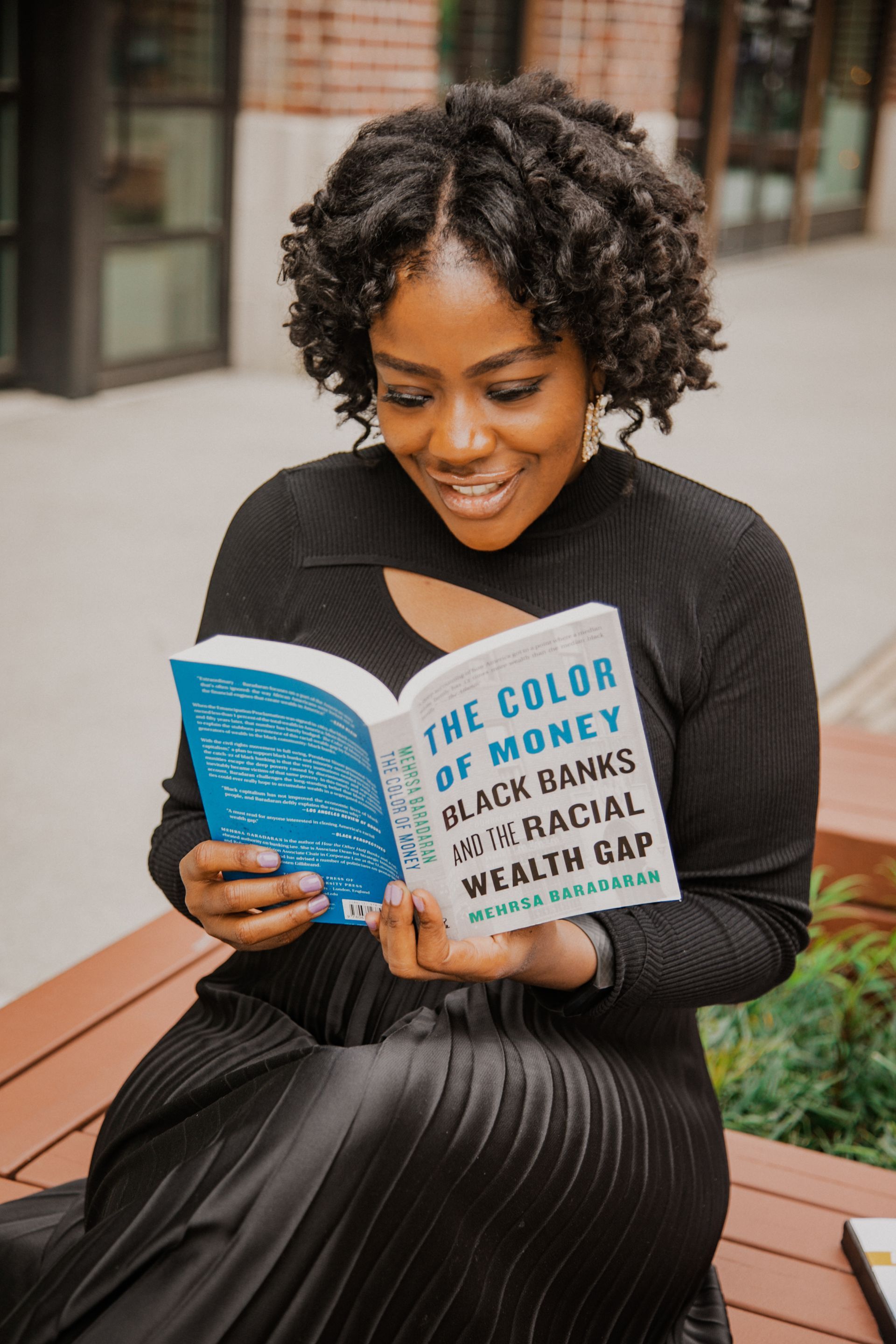

Meet your Host

Meet your Host

Hey, I’m Joshlyn and I am a Certified Financial Educator, Speaker, Content Creator, and Self-Taught Investor who has generated over $500 in monthly passive income and paid off over $80,000 in student loan debt. I’ve helped over 40 women jumpstart their investing journey and supported over 30 women in purchasing their first homes. I’ve also partnered with companies such as Fundrise, Marcus by Goldman Sachs, and Chase Bank just to name a few.

But this wasn’t always my story. Statistics show that 73% of millennials are living paycheck to paycheck and I was a part of that number for a long time. It was a combination of experiences – such as being laid off unexpectedly, quitting a toxic job with no real income plan, and struggling to purchase my first home – that taught me the importance of financial independence. Statistics also show that black women earn 63 cents for every dollar earned by white men, and I envision a world where women never have to be at the mercy of an employer (or a limited salary) ever again.

Today, as the founder of Maximized Money, I am normalizing a world where women have options and freedom. Freedom to be wherever and do whatever by using the income they earn now to create the life they’ve always desired.

JOIN THE RETIRING EARLY GANG

CONTACT ME

Thank you for contacting me!

I will get back to you as soon as possible.

Oops, there was an error sending your message.

Please try again later.

Please try again later.

Get one step closer to financial freedom!

Join the Maximized Money gang (MMG), where I regularly send tips, news, and lessons from my financial journey to your email.

Thank you!

You have successfully joined the MMG. It's lit! Check your email inbox.

Ps. Are we connected on social media?

Copyright © 2025 Maximized Money LLC.

🖤 SITE DESIGN BY ELEVAT8 DIGITAL, LLC

🖤